New Pan Card Form 49aa Free Download

How to Apply for new PAN Card

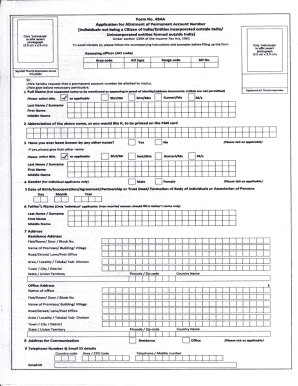

Download Revised Form No. 49A in for Application for Allotment of Permanent Account Number for residents, Revised Form No. 49AA Application for Allotment of Permanent Account Number for Foreign Companies, Citizens and Foreign Entities as applicable from. Income tax Department has. Overview of PAN Card Form. PAN Card Form 49A and Form 49AA are available for download in the UTI and NSDL websites. One can easily download PAN forms and duly fill in to apply for a new PAN Card. PAN Card is a very essential proof of identity whose main purpose is for filing income tax returns. PAN card is nowadays required to be linked with the banks.

New Pan Card Application Form 49a In Excel Free Download

The Permanent Account Number is a unique and permanent set of figures that remains unchanged throughout the lifespan of the PAN holder. It is mandatory to have a PAN card for executing various tasks such as filing income tax returns, investing in securities or property, availing banking facilities, to name a few. Entities and individuals, who qualify themselves under the bracket of taxpayers in India and wish to have financial transactions, should apply for a fresh PAN Card. Having a PAN card is a must for non-resident Indians (NRIs) living outside India and even foreign passport holders. Also, minors can apply for a PAN card through a representative assessee.

A fresh PAN card should be applied for if the Permanent Account Number has not already been allotted to the individual or entity. The procedure starts with filling and submitting an application form. It is to be noted that there are two kinds of application form - Form 49A for applicants who are Indian Citizens and Indian companies within India and Form 49AA for entities and individuals residing outside India. Relevant documents for identity verification as well as a processing fee are also required to be submitted by the applicants.

For offline support, applicants can approach any of the authorised TIN-Facilitation (TIN-FCs) and PAN centres by Alankit where dedicated professionals are there to guide them through all the stages of PAN card. Alankit guarantees exceptional services and timely assistance to potential applicants through a huge country-wide presence and strong overseas network in over 673 cities and 6120 business locations. Applicants can also visit the official website of the company and submit their application forms online to receive the PAN card faster.